Summary

A Sydney-based 3PL was losing margin due to the lack of any auditing around carrier invoices and manual management of custom sell-rate and surcharge schedules for majority of their customers. Dyspach was brought in to automate the customer onboarding on bespoke sell rates, carrier invoice auditing and automating the end to end invoicing workflows to improve cashflow and stop margin leaks. The result was a 5% net margin recovery within the first 45 days, billing cycle cut from days to minutes, and eliminating of the need of 2 additional FTEs in the finance team and 1 commercial analyst.

Challenges

The market is tough and the sales reps do what they can to win deals, in other words, they frequently use pricing models like flat customised sell rates, sell rates + markups, margins and cost plus, all mixed up in order to win deals. This created highly painful and custom workflows for the onboarding and finance teams, taking weeks/months to bill customers and a lot of noise from the customers querying the charges. The delays caused backlog of invoices, leading to poor cashflow and no visibility on the margin per account. The CFO was struggling particularly with cashflow, leaks and the time consuming manual work for the finance team to invoice shipping.

Alternatives

Prior to Dyspach, the finance team billed manually from lodged shipment dimensions and weights, then absorbed the actual carrier charges. Each customer invoice was prepared individually using Excel macros that pulled data from multiple sheets, often crashing or freezing machines. Sell rates had to be calculated manually from rate cards, markup details buried in emails, and a central spreadsheet that was rarely updated. To control leakage, they attempted selective shipment audits and re-billing, but this created more customer disputes and payment delays, so the process was abandoned. The team also explored offshoring by hiring two logistics finance staff in Manila (USD 10/hour, ~AUD 5,000/month). While feasible in theory, the reliance on manual checks, training overhead, and scalability issues led them to scrap the plan. It's safe to mention here that a full-time proactive and experienced business / commercial analyst that has background in freight is not only hard to come by, they are extremely expensive to hire too, including the hiring costs, the first year costs alone could be AUD 150,000 easily.

Solution

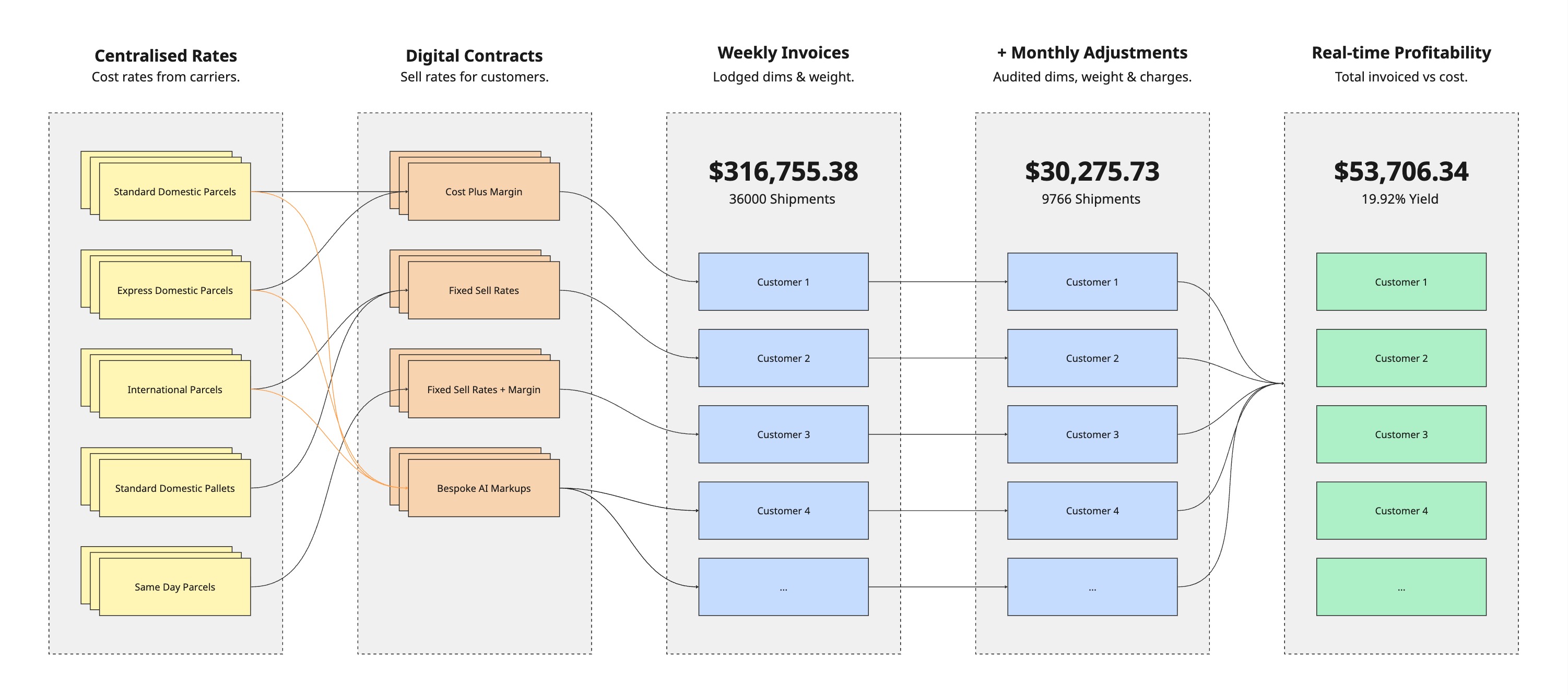

With Dyspach, the 3PL automated the entire rate management, contract management, auditing and billing process.

The transformation began by empowering the sales team to set up customers for billing directly in Dyspach, based on their sales agreements and contracts. From there, billing was automated using lodged dimensions, fully aligned with customer terms. Next came tackling the biggest source of margin leakage, auditing. We streamlined carrier invoice auditing by automating ingestion, cross-checking invoices against lodgement reports and cost rates, and flagging discrepancies in weight, size, and surcharges. Finally, we automated the production of adjustments / reconciled fees for re-measured dimensions, weight, and additional charges, ensuring these flowed back to customer invoices according to contract. The result: real-time visibility into margin per account and invoices instantly exportable in custom formats, without any human intervention.

The transformation began by empowering the sales team to set up customers for billing directly in Dyspach, based on their sales agreements and contracts. From there, billing was automated using lodged dimensions, fully aligned with customer terms. Next came tackling the biggest source of margin leakage, auditing. We streamlined carrier invoice auditing by automating ingestion, cross-checking invoices against lodgement reports and cost rates, and flagging discrepancies in weight, size, and surcharges. Finally, we automated the production of adjustments / reconciled fees for re-measured dimensions, weight, and additional charges, ensuring these flowed back to customer invoices according to contract. The result: real-time visibility into margin per account and invoices instantly exportable in custom formats, without any human intervention.

Implementation

We kicked-off with a fixed-scope pilot for 1 carrier (Australia Post) to demonstrate the end-to-end workflow and the recovery of leaks in parallel to their current processes so they could compare, of course without all the automation. Once the pilot was confirmed to deliver the margin leaks and we showed them where we could insert the automation, the finance team bought in and it took 3 more weeks to onboard the rest of their customers and 5 other carriers (CP, Aramex, DFE, Parcel Right, DHL) (the pilot lasted for 45 days). Once the implementation was completed, there was additional training and hand-holding the finance team needed which was provided on priority and by month two, they were up and running and we don't hear any special requests anymore — other than feature requests and some minor user experience defects/bugs which are a welcomed as there is no other way to improve the product other than from customer feedback.

Results

Within the first 45 days aka the pilot period, and without any automation, the 3PL was able to increase their net margin 4-5% by fixing the leaks in invoicing workflows involving just 1 carrier, after which we started adding more carriers into the mix. Once the full solution was deployed, the sales team could easily configure customers to bill shipping, and the finance team not only saved months to find, onboard and manage more team members, they also saved countless hours of manual work which is not done in minutes or let's be real-real, billing 100 customers with an average of 5000 shipments per month takes less than 1 hour in total without any leaks or human intervention. Imagine the problem solving capacity that is created, using which talented team members can actually spend time looking after customers, and themselves increasing stickiness for both internal and external customers.

What's next?

For this customer, once the new invoicing automation has settled as a "business as usual" process, they want us to start helping their sales team to transition from cost plus into bespoke sell rate selling which maximises the margin right from the start. If you are struggling with peace of mind around margin leaks in shipping and staff working on redundant excel activities, get in touch and we'd love to do a fixed-scope pilot with you to demonstrate the benefits first-hand.

Published on September 23, 2025 • Case Studies